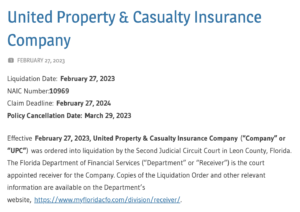

United Property & Casualty Insurance Company (UPCIC) was a property and casualty insurance company that was liquidated on February 27, 2023. The liquidation process is designed to protect policyholders and creditors of the company by distributing the company’s assets in an orderly and equitable manner. In this article, we will discuss what happens to policyholders with claims against UPCIC and how the Florida Insurance Guaranty Association (FIGA) can help.

When an insurance company like UPCIC is liquidated, its assets are sold to pay off its debts and obligations. Claims made by policyholders are considered liabilities and are paid out of the assets of the company. However, the amount of money available to pay claims may be limited, and not all claims may be fully paid.

This is where FIGA comes in. FIGA is a non-profit, state-run organization that provides a safety net for policyholders of insolvent insurance companies. It is funded by assessments on insurance companies operating in Florida and is responsible for paying claims on behalf of insolvent insurers.

If you have a claim against UPCIC, you should first contact the liquidator appointed by the state insurance department where the company was based. The liquidator will be responsible for handling the claims process and determining the amount of money available to pay claims.

If the liquidator determines that your claim is valid and there are not enough assets to fully pay your claim, FIGA may step in to provide additional coverage. FIGA provides coverage for certain types of claims, including property damage, bodily injury, and death benefits. However, there are limits to the coverage provided by FIGA.

For example, FIGA provides coverage up to $300,000 for claims related to property damage or loss, and up to $300,000 for claims related to bodily injury or death. These limits apply per claimant, not per policy. Additionally, there are limits on the types of claims that FIGA covers.

For example, FIGA does not cover claims for workers’ compensation or employer’s liability, claims made by insurers, or claims made by policyholders whose policies were not in force at the time the insurer became insolvent.

If you have a claim against UPCIC, it is important to understand your rights and options. You should contact the liquidator and FIGA for more information about the claims process and the coverage available to you. While the liquidation of UPCIC may be a difficult and uncertain time, FIGA is available to help policyholders navigate the claims process and provide additional coverage where possible.

ADVICE:

If you opened a claim with UPC insurance, our team can help you get paid, we have handled multiple FIGA claims in the past and are confident we can assist you in these troubling times. Call me at (786) 818-942 or email me at Armando@CaliberAdjusters.com

FIGA LIQUIDATION NOTICE: VIEW HERE